Men and women need life insurance, but traditionally, men invest in coverage more frequently than women. According to the Friends Provident International (FPI) survey conducted by YouGov, only 19% of female participants were covered by life insurance. When it comes to life insurance, a majority of women are underinsured or they are not insured at all.

Whether you are the primary breadwinner, a single parent, a stay-at-home mom, or fall somewhere in between, women need life insurance to protect the financial interest of their family in the event of a fatal accident or illness. Term Life Insurance is one way you can help keep your family secure. Petra makes it easy to find a plan that fits your needs.

Here’s what every woman needs to know about life insurance.

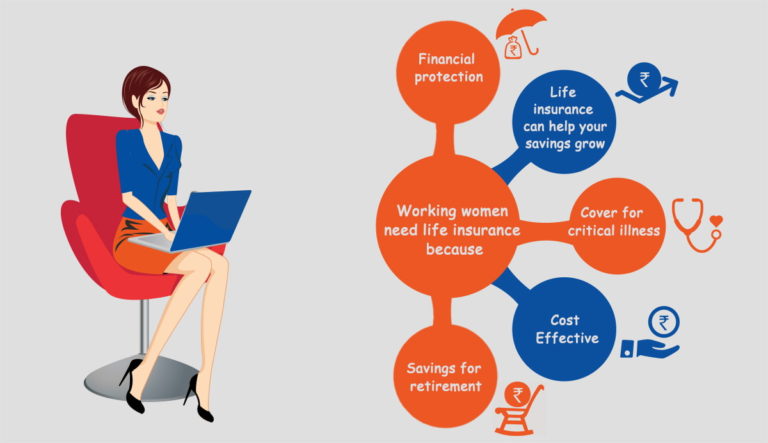

Life Insurance for Working Women

Now more than ever, many households depend on the income of two working parents to support their lifestyle. As a working mother or wife, your income has a significant impact on your family’s quality of life. Even if you aren’t the primary income provider, your income helps to cover the cost of various bills, clothing, food, and utilities. Additionally, your income contributes to savings for your children’s education and future retirement.

You may still be wondering, “Do I need life insurance?” However, you should ask yourself, “If I die tomorrow, will my family be able to maintain their standard of living?” Not only will life insurance helps your family maintain their lifestyle, but it will also ease the burden associated with funeral and burial costs. Whether you are the primary breadwinner or a seconding provider, life insurance will help to protect your financial interests.

Life-Insurance for Stay-at-Home-Moms

Not all women work out of the home. Maintaining a household is a full-time job, and stay-at-home mothers play a vital role in their household. In fact, the cost associated with the services performed by a stay-at-home mom would be quite pricey if someone had to be hired to do them.

In the event of the untimely death of a stay-at-home parent, their spouse would need to take over these responsibilities, which would shorten their work hours. Fewer hours lead to a reduction in income, which would impact the quality of life for your family. Life insurance can help your spouse pay for the services that keep the household running, as well as funeral and burial costs.

Life Insurance for Single Parents

Single parents have just as much, if not more of a need for life insurance than their counterparts. Remember, insurance is really for the family you leave behind. As the sole parent, if something happens to you, you need to make sure your children still have a secure future. Life insurance will help their guardians maintain the life they have grown accustomed to.

Life Insurance for Single Women and Single Parents

Like men, women make the mistake of thinking life insurance isn’t necessary because they have no dependents. However, these individuals overlook the fact that life insurance provides the necessary funds needed to settle student loans, auto loans, mortgages, and other debts. Without life insurance, these expenses might otherwise fall to the responsibility of surviving family members.

How Much Life Insurance Do You Need?

Before you purchase a life insurance policy, you need to calculate how large a policy you need. To get started, consider how your loved ones will use the life insurance policy. It’s important you provide your family with enough life insurance coverage. If your plan is too small, then your family could be left with additional expenses and no money to pay for those bills.

Generally, the main purpose of life insurance is to pay off debts, such as your mortgage, funeral expenses, and medical bills. In addition to your debts, it’s important to consider your income (as your family depends on your salary for their quality of life). Ideally, your life insurance policy will be greater than the combined sum of your annual salary and debts.

Petra Insurance

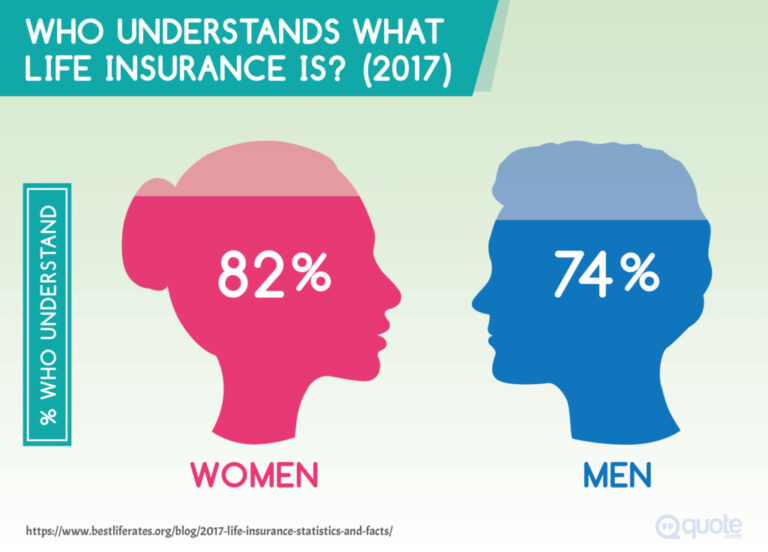

On average, women have a longer life expectancy than men, which means insurance providers see you as a less risky client. This means lower premiums. In general, the younger you are when you apply for life insurance, the lower your rates will be (if you are healthy).

At Petra Insurance Brokers, we leverage our decades of industry experience and expertise to find the best coverage to protect your family and legacy. Regardless of your age, medical history, or career, our team of advisors are ready to provide you with a quote for new coverage or help you review your existing coverage.

Contact a member of our team today to find out how we can help you protect the life you’ve worked so hard to build. You can also reach us on Facebook, Instagram, Twitter, and LinkedIn.

We look forward to hearing from you.

RAMZI GHURANI

Managing Partner